Speculation of Inflation-Cruise Bookings, Oil, The Dollar & Something Called Breakeven

- 2244 Online

- Feb 26, 2021

- 2 min read

The Economist February 20th 2021 pp64 |Finance & economics| Buttonwood “Jumping Ship” “What marked-based measures do and don’t tell you about inflation fears.”

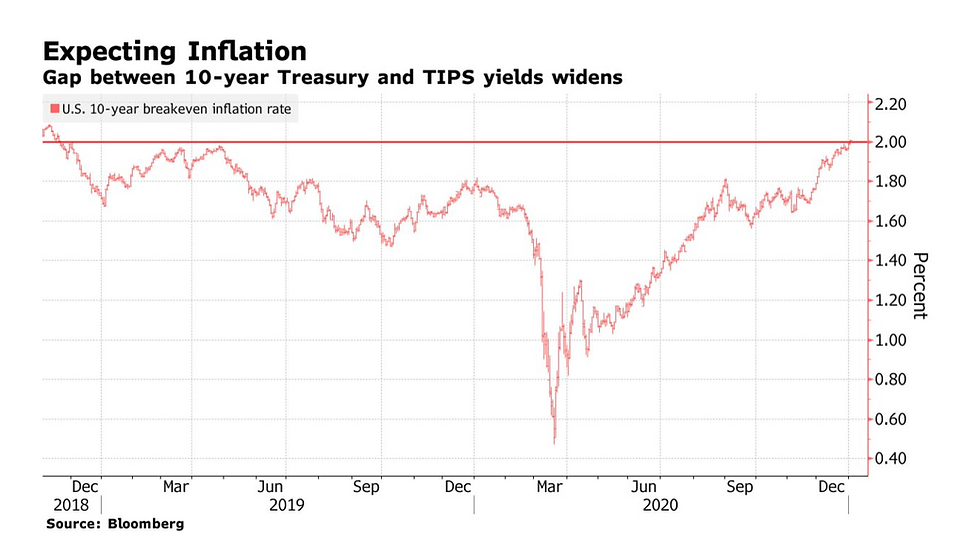

From Bloomberg January 4, 2021. Current the Gap is 2.2% according to The Economist article summarized below. Note that this is the highest since December 2018. Janet Yellen, U.S. Treasury Secretary, says willing to sustain around 2% for a while.

Read the article for full detail

Summary of the Article

Oddly enough Carnival Cruise Lines could now be thought of as one measure of the potential for inflation. In what has been an unusual excursion from sinking at the onset of pandemic, literally as “petri dishes”stuck at the dock, to now having their bookings for the “first half of 2022…above their level in 2019 some worry that inflation could follow, at least temporarily, particularly for consumption of goods and services in limited supply. Even that is a question in a global economy exceptions temporarily being some commodities. Other inflation indicators include commodity prices-which are rising, oil prices and the valuation of the dollar. Early in the pandemic “there was a glut of crude oil in storage and in seaborne tankers. At that time, the month-ahead price of oil briefly turned negative. A year on, inventories are falling … [and]…The price of a barrel of Brent crude has surged past $60.” A model by Steve Englander (Standard Chartered Bank) uses oil and the dollar to predict the difference between inflation-protected U. S. Treasuries versus the traditional, ultimate safe asset, 10 Year U.S. Treasury bond. His model, based on data from 2006-2016, has predicted the recent GAP (TIPS-10Year) run-up from a low during the pandemic of 0.5% (March 2020) to 2.2% now. Rightly or otherwise the GAP also known as "Breakeven" is widely followed as a predictor of future inflation. Estimating the future inflation is obviously important for budgeting material, service and labor expenses for all organizations and businesses. For an investor, if you invested in TIPS at 2.2% and interest rates rose you would benefit but if future interest rates fall you would have been better invested in traditional 10 year U.S. Treasury bonds.

And so now the dialog is heating up about the potential for inflation becoming meaningful especially because it’s likely that America will soon take action for another stimulus to help citizens cope with the fallout from the pandemic. In total, that estimated $1.9trn some argue will drive inflation especially if other rich countries don’t participate as well. At least Buttonwood believes, at this point, that the rise in breakeven is “mostly the shifting of attitudes to risk, rather than forecasts of inflation.” Treasury Secretary Janet Yellen has signaled a willingness to tolerate inflation at 2% at least for a while.

Comments