Money Evolves-Goverment E-Coin the Next Iteration, Proceed with Caution!

- 2244 Online

- May 14, 2021

- 3 min read

The Economist May 8th 2021 pp13 |Leaders|”The digital currencies that matter” “Government-run virtual currencies are coming. They are a giant risk that is worth taking”

Read The Economist article for all detail

Image from Wikipedia.org

Summary provided by 2244

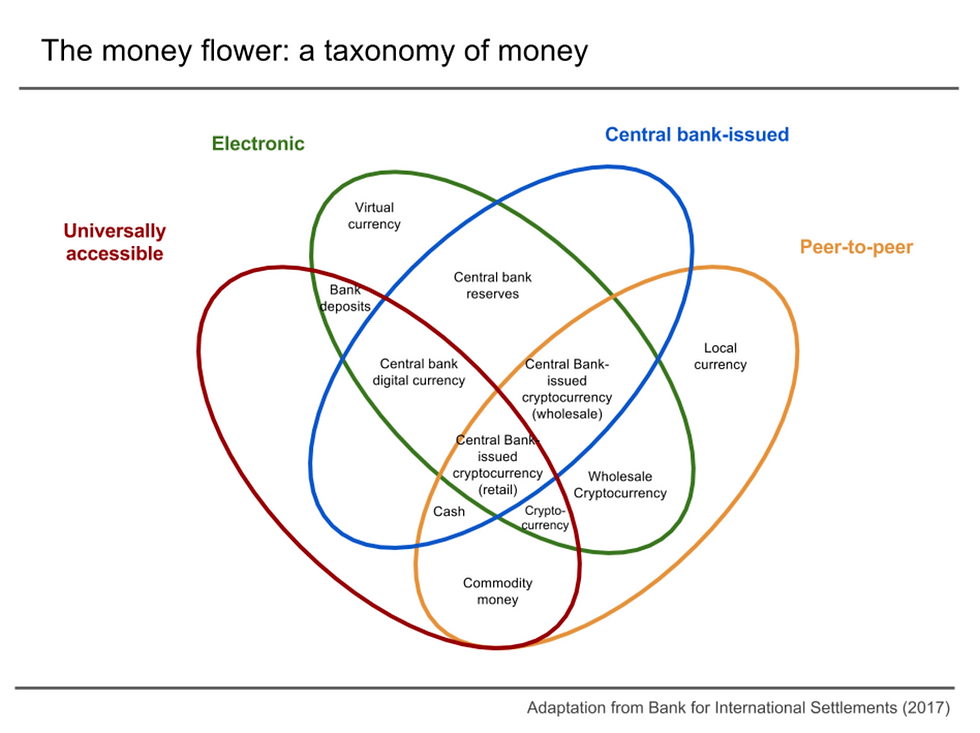

Businesses, Financial Institutions and even Countries are increasingly moving toward digital currencies. For most of us, we are familiar with physical currency-bills/coins and credit cards and less familiar with digital facilities like PayPal, Venmo, Zelle etc. and largely in the dark about Bitcoin et al. and now there’s the emerging likelihood of government e-commerce-dubbed broadly as Govcoin.

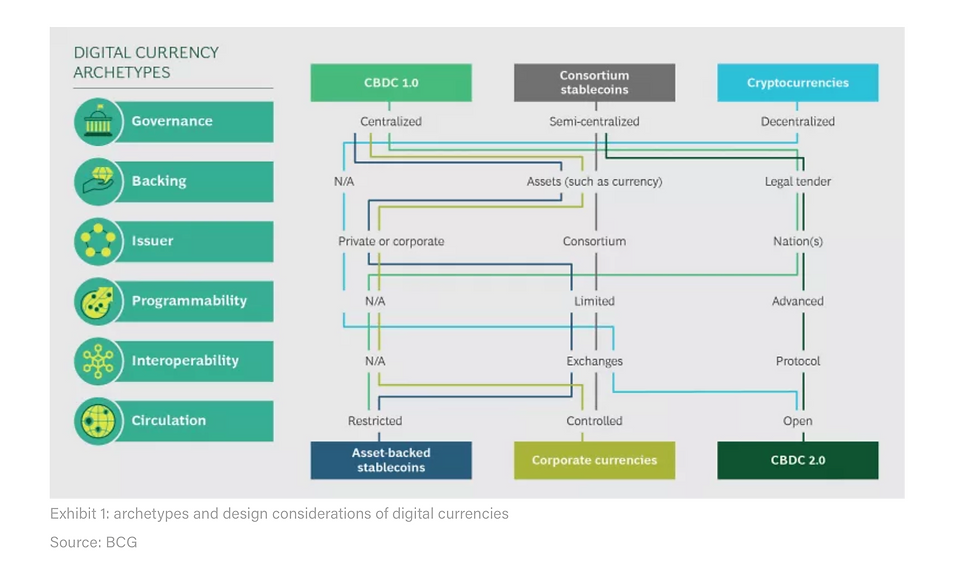

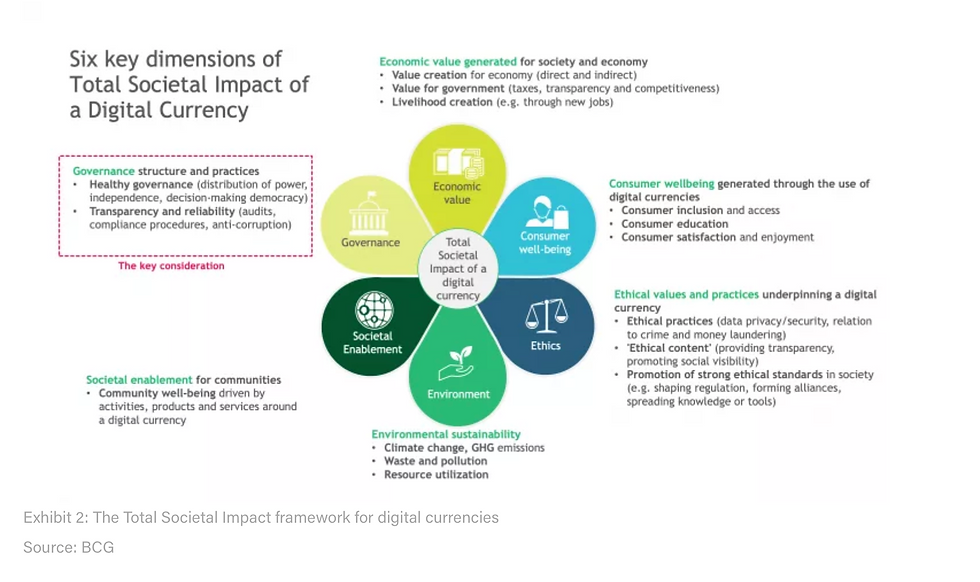

Government digital currencies “aim to let people deposit funds directly with a central bank, bypassing conventional lenders. Benefits/Risks of Govcoins-“make finance work better…but [shifts] power from individuals to the state”. Such a shift could change geopolitics, threaten the green back as the reserve currency, and could “change how capital is allocated” by squeezing out private lenders. Govcoins customer interface could operate like Venmo etc. but be backed by the government and remove costs to the financial system currently taken by credit cards etc.

Image from coin desk.com

Who is pursuing Govcoins?

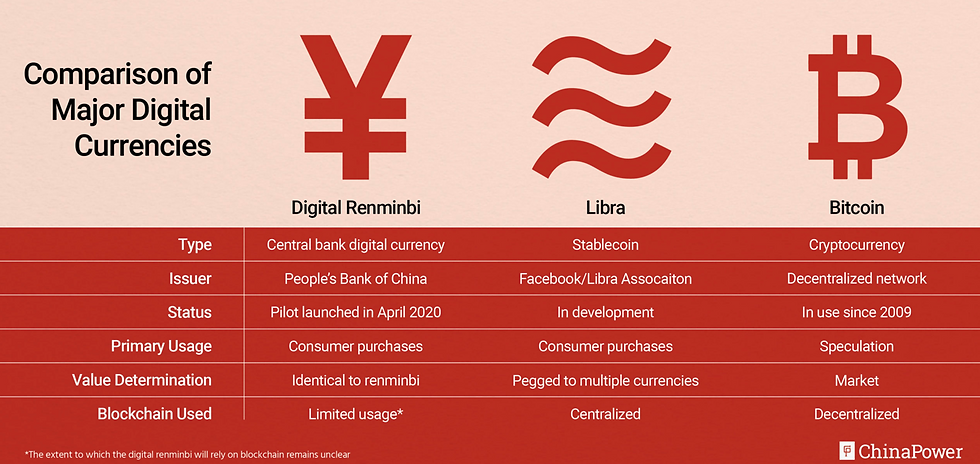

So far, “over 50 monetary authorities, representing the bulk of global GDP, are exploring digital currencies.” “China has rolled out its e-yuan pilot to over 500,000…the EU wants a virtual euro by 2025, Britain has launched a task-force, and America…is building a hypothetical e-dollar.”

What motivates governments/central-banks to create a digital currency?

First, they have “a fear of losing control” that they use now to “manage the economic cycle” including injecting “funds into the system during a crisis.” Second, they worry that “unsupervised private networks could become a Wild West of fraud and privacy abuses.” Third, there is the “promise of a better financial system”-“ a reliable store of value, a stable unit of account and an efficient means of payment.” Such a Govcoin option would help alleviate some of the current problems relating to uninsured deposits, cost of credit cards and private e-coins like bitcoin-not “widely accepted.” Governments could easily then “make instant payments to citizens and cut interest rates to below zero.”

Image from coindesk.com

What would this mean to the financial industry?

Currently the financial, rakes in fees totally about “$350 a year for every person on Earth.” “That could make finance accessible to the 1.7B people” without bank accounts. Such an unrestrained move could “destabilize banks” as private banks would need to “find other sources of funding with which to back their loans.”

What are some key concerns about Govcoins?

A key concern is that government, if they were sole source for finance, could control the allocation of funds and “in a crisis, a digital stampede of savers to the central bank, could cause bank runs.” Another obvious concern is that the state could then have undue control over citizens and even apply “instant e-fines for bad behavior.” Such a move to Govcoins could disrupt the status quo of the Greenback as digital systems could provide a “conduit for cross-border payments.” “Small countries fear that, instead of using local money, people might switch to foreign e-currencies…”. It’s not hard to imagine that “China’s autocrats…[will be] limiting the size of e-yuan and clamping down on private platforms such as Ant.”

How to initially deal with Govcoin concerns?

Key points are; “cap..digital currency…, prepare for a long-term shift in how money works,…[set up] privacy laws, [be] reforming how central banks are run and preparing retail banks for a more peripheral role.”

Image from china.power.csis.org

Comments