A Blip or A Trend, The Question Remains the Same

- 2244 Online

- Sep 19, 2021

- 2 min read

Bloomberg September 18, 2021 10:00 AM “Early Alarm Bells Ringing for Market Showing Signs of Fatigue” by Lu Wang

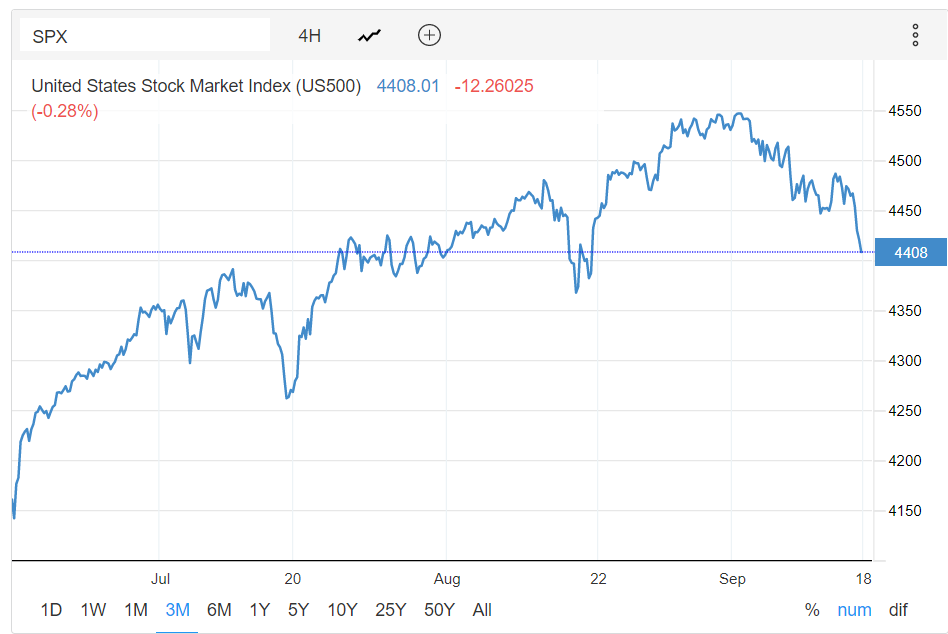

Image from Trending Economics

Read Bloomberg.com for all the detail.

Summary offered by 2244

“An alarming number of companies have warned that profits won’t meet expectations when they report in a month.” Some of these companies are in the materials sector, a small fraction of the S&P500, whose performance has historically been a leading indicator for the broader market. There is a general sense that these recent “profit warnings come as economic growth is slowing, price increases for final products and services are missing forecasts and wage pressure is building.” Some market indicators like 2021 EPS and 2022 EPS estimates seem to be reaching a plateau as well. These findings in aggregate could “undermine key support” that has been driving the market for the last 18 months.

In this up market, the S&P500 P/E ratio has been running above an average of 19.6 but some analysts now worry the trend may be reversing. A narrative that more may agree with is that “supply-chain bottlenecks and inflation pressure” may make it harder to meet forecasts. Traditional market-watchers comment that historically some of the largest market declines have followed a “peak in margin forecasts.” To the contrary, others note that true growth is slower due to “delta and other factors” but the growth rate is still strong at “maybe 4% and 4.5% next year.” Lastly, the big question remains whether or not the recent run-up of inflation is just a blip rather than a trend. Gina Martin Adams (Bloomberg) notes “If the August stall in expectation turns into an outright decline, it’s likely to lead to a drop in the market at large.”

Comments